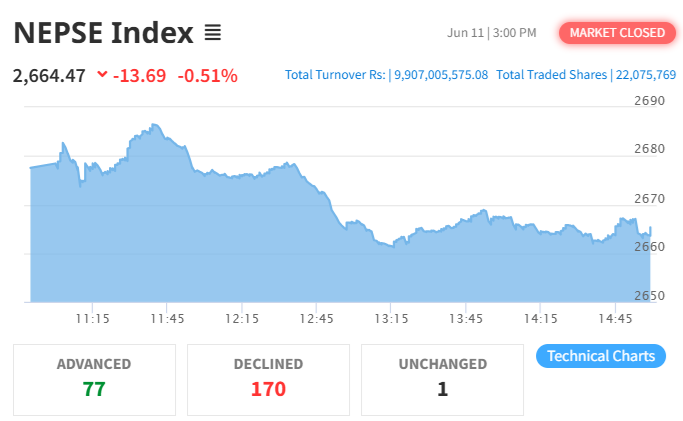

The Nepal Stock Exchange (NEPSE) Index experienced a decline on Tuesday, shedding 13.69 points or 0.51% to close at 2,664.47 points, a day after gaining momentum in the previous trading session. The decline comes as part of a broader wave of cautious sentiment in the market, with investors showing signs of profit booking following Monday’s 25.07-point rise.

The day’s trading session was marked by a relatively high level of activity. The benchmark NEPSE index opened at 2,677.53, reflecting some initial optimism among investors. However, the momentum couldn’t be sustained as the index reached an intraday high of 2,686.45 before gradually sliding to an intraday low of 2,660.86, ultimately closing nearer to its lower band for the day.

Market Turnover and Transactions

Total turnover for the day stood at Rs. 9.90 Arba, with a total of 22,075,769 shares changing hands. These shares were traded across 307 listed companies, executed through 81,703 transactions, indicating active investor participation despite the bearish sentiment.

In terms of market value, market capitalization was recorded at Rs. 44.38 Kharba, while the float market capitalization stood at Rs. 14.96 Kharba, reflecting the overall dip in stock values and investor confidence.

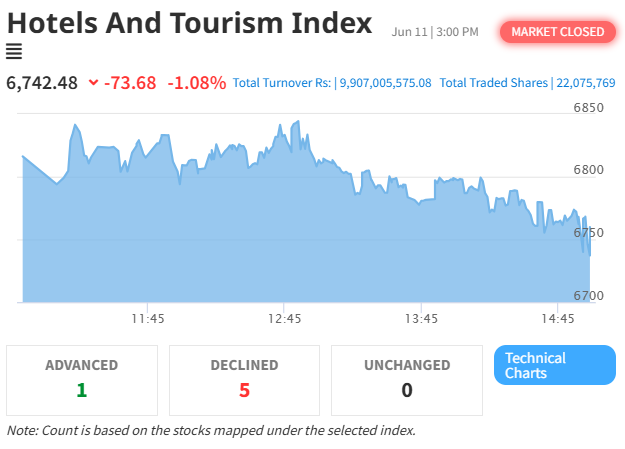

Sector Highlights: Hotels and Tourism Index Falls

The Hotels and Tourism sub-index, which had posted impressive gains in the previous session, also followed the broader market downtrend. The index fell by 73.68 points or 1.08%, closing at 6,742.48 points.

During the session, the Hotels and Tourism index opened strong at 6,816.17, touching a peak of 6,844.25, but later reversed to hit an intraday low of 6,734.04, signaling increased volatility in tourism-related stocks. This drop follows Monday’s robust gain of 86.47 points, suggesting that investors may have engaged in profit booking in the hotel and tourism sector after the short rally.

Analysis and Investor Sentiment

Market analysts suggest that today’s dip in NEPSE is largely the result of profit-taking behavior by short-term traders, especially in the wake of the previous day’s rally. Uncertainty in the global financial landscape, coupled with local economic concerns, has further added to the cautious tone among investors.

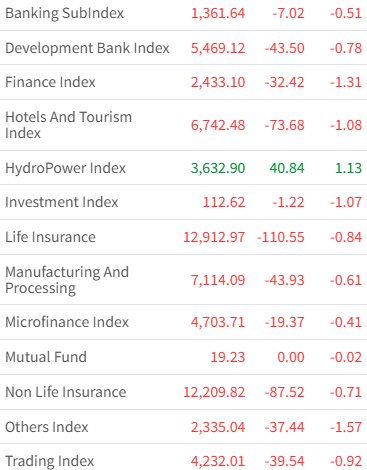

Despite high turnover and substantial participation, the sentiment appeared mixed, with many investors opting to secure gains from Monday’s positive session rather than re-enter the market. The selling pressure was more pronounced in key sectors like banking, hydropower, and especially tourism, which has shown notable fluctuations over the past week.

Tourism Sector Performance and Outlook

The performance of the Hotels and Tourism Index is often viewed as a bellwether for Nepal’s travel and hospitality economy. With recent efforts to revive Nepal’s tourism post-pandemic, the sector had seen renewed investor interest. However, today’s loss suggests that tourism stocks remain sensitive to broader market movements and investor expectations regarding recovery timelines.

Stocks of major hotel chains, tour operators, and hospitality groups saw price corrections, with many blue-chip tourism stocks retracing their recent gains. Nonetheless, long-term outlooks remain optimistic, with tourism stakeholders expecting increased footfall in the upcoming fall season, a traditionally strong period for travel in Nepal.

Market Cap Snapshot

At the end of the session, NEPSE’s total market capitalization of Rs. 44.38 Kharba represents a mild decline compared to recent peaks. Similarly, the float market cap, which considers only shares available for public trading, stands at Rs. 14.96 Kharba, indicating the reduction in stock valuations across the board.

What Lies Ahead

Investors and analysts will be closely watching upcoming policy announcements, interest rate trends, and economic data releases for further direction. With liquidity remaining relatively steady and trading volumes holding firm, the market may see sideways movement in the coming days unless triggered by significant macroeconomic events or corporate earnings announcements.

In the short term, volatility is expected to persist, especially in sectors like tourism and banking, which are closely tied to consumer sentiment and fiscal policy changes. Investors are advised to remain cautious, focusing on fundamentally strong stocks and keeping an eye on sector-specific developments.

Today’s market performance underscores the continued volatility in NEPSE despite strong turnover and participation. The decline in the Hotels and Tourism Index also reflects the fragility of sectoral gains in the absence of long-term market stability. As the market adjusts to domestic and global factors, cautious optimism and strategic investing are likely to shape investor behavior in the sessions to come.