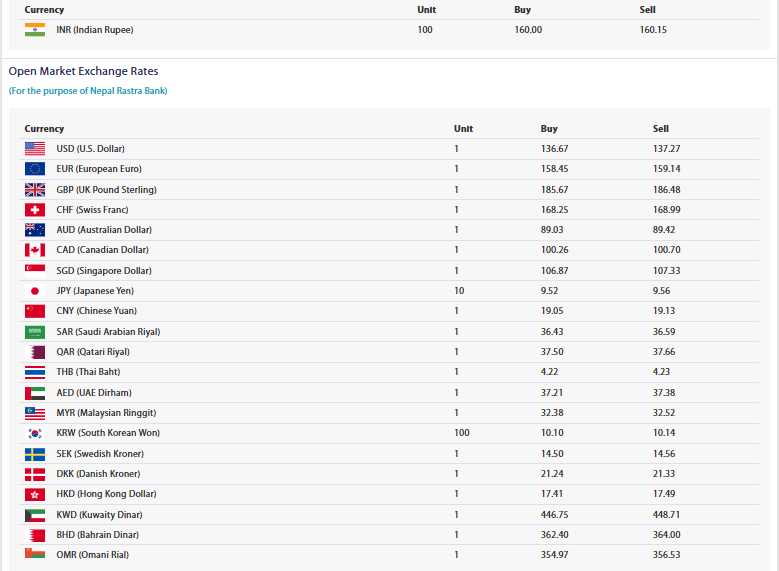

Nepal Rastra Bank (NRB), the central regulatory authority of the nation’s monetary policy, has released the official foreign exchange rates for today. These rates, issued daily, serve as the benchmark for commercial transactions involving foreign currencies. The update includes buying and selling rates of major global currencies, reflecting the dynamic nature of global financial markets and Nepal’s position within it.

The exchange rate, as determined by NRB, is pivotal for importers, exporters, foreign travelers, and businesses engaging in international transactions. It not only impacts trade and tourism but also has ripple effects on remittances, investment decisions, and overall economic performance.

USD and Other Major Currencies: A Close Watch on the Dollar

As per the latest announcement, the buying rate of one U.S. Dollar (USD) has been fixed at Rs. 136.67, while the selling rate stands at Rs. 137.27. The U.S. Dollar, being the most widely used reserve currency in the world, holds significant influence over Nepal’s foreign trade and tourism-based transactions.

This rate is closely monitored by traders and investors as it impacts import costs of petroleum, machinery, and electronic goods, which Nepal primarily pays in USD. Similarly, tourism and remittance sectors, which receive payments in dollars, benefit when the dollar strengthens against the Nepali rupee.

Euro and British Pound: Slight Movements in European Currencies

Among the European currencies, the Euro (EUR) saw a buying rate of Rs. 158.45 and a selling rate of Rs. 159.14. Meanwhile, the British Pound Sterling (GBP) was set at a buying rate of Rs. 185.67 and a selling rate of Rs. 186.48.

The appreciation of these currencies indicates a slightly stronger European market trend. Tourists from Europe and Nepali students abroad are often affected by these rates. The stronger pound also implies higher costs for those planning to study or travel in the UK, whereas returnees and remittance receivers stand to gain.

Swiss Franc and Other Strong Economies’ Currencies

The Swiss Franc (CHF), considered one of the world’s safest currencies, is being bought at Rs. 168.25 and sold at Rs. 168.99. This currency’s consistent strength is a reflection of Switzerland’s stable economy.

Meanwhile, the Canadian Dollar (CAD) has been fixed at Rs. 100.26 for buying and Rs. 100.70 for selling. The Australian Dollar (AUD) is available at Rs. 89.03 (buying) and Rs. 89.42 (selling). The Singapore Dollar (SGD) is also in the mix, with buying and selling rates of Rs. 106.87 and Rs. 107.33 respectively. These currencies are particularly important for Nepali students, professionals, and migrant workers based in these countries.

East Asian Currencies and Their Position Today

The Japanese Yen (JPY), quoted for 10 units, is being bought at Rs. 9.52 and sold at Rs. 9.56. The Chinese Yuan (CNY), a key trading currency for Nepal, stands at Rs. 19.05 (buying) and Rs. 19.13 (selling).

The Chinese Yuan is closely followed due to Nepal’s high-volume imports from China. Similarly, the South Korean Won (KRW), quoted for 100 units, is being bought at Rs. 10.10 and sold at Rs. 10.14. These exchange rates play a significant role in regulating consumer prices in the Nepali market for electronics, textiles, and manufactured goods.

Gulf and Middle East Currencies: Relevant for Remittance Inflow

The currencies of Gulf countries, a major source of remittance for Nepal, are also prominently listed. The Saudi Arabian Riyal (SAR) is bought at Rs. 36.43 and sold at Rs. 36.59, while the Qatari Riyal (QAR) is pegged at Rs. 37.50 (buying) and Rs. 37.66 (selling).

Similarly, the UAE Dirham (AED) is available at Rs. 37.21 for buying and Rs. 37.38 for selling. These rates are essential for millions of Nepalis working in the Gulf region who regularly send money back home.

In the high-value category, the Kuwaiti Dinar (KWD) is set at Rs. 446.75 (buying) and Rs. 448.71 (selling), one of the most expensive foreign currencies traded in Nepal. The Bahraini Dinar (BHD) is quoted at Rs. 362.40 (buying) and Rs. 364.00 (selling), while the Omani Riyal (OMR) stands at Rs. 354.97 for buying and Rs. 356.53 for selling.

Other Asian and Scandinavian Currencies

The Thai Baht (THB) is listed at Rs. 4.22 (buying) and Rs. 4.23 (selling). The Malaysian Ringgit (MYR), another key currency for remittance, is priced at Rs. 32.38 for buying and Rs. 32.42 for selling.

From the Scandinavian bloc, the Swedish Kroner (SEK) is listed at Rs. 14.50 (buying) and Rs. 14.56 (selling), while the Danish Kroner (DKK) is surprisingly recorded with a buying rate of Rs. 21.24, slightly higher than the selling rate of Rs. 21.23, which may be due to rounding discrepancies or temporary price fluctuations.

Indian Rupee Exchange Rate

The Indian Rupee (INR), a key currency in Nepal due to open border trade and significant daily exchange, has been fixed at Rs. 160.00 for buying and Rs. 160.15 for selling per 100 INR. Given the deep economic interconnection between Nepal and India, even minor fluctuations in this rate affect prices of essentials like vegetables, petroleum, and medicines.

Exchange Rates Subject to Change

Nepal Rastra Bank has also clarified that these rates are subject to revision as per necessity and may change at any time based on international market fluctuations. Furthermore, commercial banks may offer slightly different rates for buying and selling foreign currencies depending on their policies and operational strategies.

The most updated and official exchange rates can always be accessed via the Nepal Rastra Bank’s official website, ensuring transparency and accuracy for both individuals and businesses dealing in foreign currencies.