The Nepal Stock Exchange (NEPSE) witnessed a significant decline today, shedding 30.36 points or 1.05%, closing at 2,846.30. This downturn extends the losses from the previous session, which saw a decline of 13.62 points. The market’s volatility was evident throughout the trading day, with the session opening at 2,877.22 before fluctuating between a high of 2,894.62 and a low of 2,842.78. Despite the downturn, trading activity remained robust, with a total turnover of Rs. 12.94 Arba. Investors engaged in 122,336 transactions, involving 26,389,910 shares across 318 listed companies.

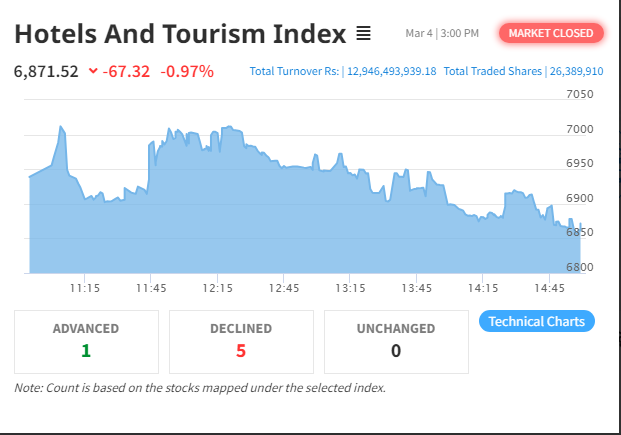

The bearish sentiment also impacted the Hotels and Tourism Index, which recorded a loss of 67.32 points, equivalent to 0.97%, settling at 6,871.52. This follows a substantial decline of 133.09 points in the previous session, indicating continued selling pressure in the sector. The index opened at 6,938.85 and experienced fluctuations, reaching a high of 7,011.90 before dropping to an intraday low of 6,855.27. The total turnover for the day mirrored the broader market, reaching Rs. 12.94 Arba, with identical transaction volume and share trade figures.

The continued decline in the NEPSE index suggests persistent market uncertainties, with investor sentiment influenced by various economic and financial factors. The Hotels and Tourism sector, in particular, has been experiencing consecutive declines, which could be attributed to concerns over tourism recovery, global economic conditions, or profit-booking by investors. The overall turnover indicates sustained investor participation, though the declining index reflects a cautious market outlook.

Market analysts suggest that external economic pressures, fluctuating liquidity conditions, and investor sentiment towards risk assets might be contributing to the current downward trend. As the market remains volatile, investors are likely to keep a close watch on sectoral performances, economic policies, and global financial trends that could influence NEPSE’s trajectory in the coming days.