The Nepal Stock Exchange (NEPSE) experienced a minor setback today, with the benchmark index falling by 7.26 points, or 0.27%, to close at 2,678.47. This decline follows a modest gain of 1.86 points in the previous trading session, reflecting continued fluctuations in market sentiment.

The trading session opened at 2,686.77, showing an initial positive outlook before market forces drove the index to fluctuate between an intraday high of 2,697.34 and a low of 2,673.88. This movement suggests that despite the broader market’s attempt to sustain gains, selling pressure led to a pullback. Investors appeared cautious, possibly due to ongoing market volatility and sector-specific concerns affecting trading behavior.

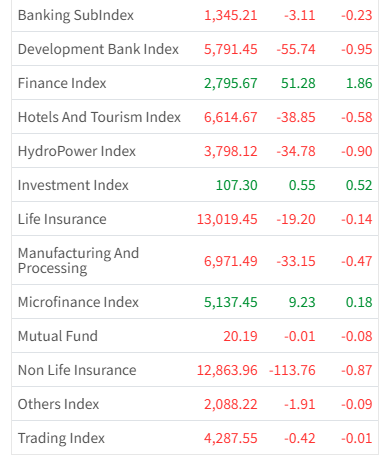

Among the sectoral indices, the Hotel and Tourism Index continued its downward trajectory, extending its losses from the previous session. The index declined by 38.85 points (0.58%), settling at 6,614.67. This follows a prior session loss of 42.72 points, highlighting sustained selling pressure in the sector. The session started at 6,654.83, reaching an intraday peak of 6,730.29, before descending to a low of 6,603.90.

Market analysts suggest that NEPSE’s decline is linked to multiple factors, including profit booking by short-term traders, cautious investor sentiment, and global market trends. The recent gains in certain sectors may have prompted investors to lock in profits, contributing to the minor drop in the index. Additionally, external economic factors, such as inflation concerns and interest rate policies, continue to influence investor confidence.

For the Hotel and Tourism sector, the continued decline may be attributed to seasonal fluctuations, investor concerns over international tourist arrivals, and economic factors affecting travel demand. With Nepal’s tourism industry still in the process of full recovery post-pandemic, market participants may be re-evaluating their positions in hospitality stocks. Despite the minor setback, market experts believe that NEPSE remains within a consolidation phase, with the potential for an upward breakout if economic indicators remain stable.

The market’s ability to sustain key support levels will be crucial in determining future trends. In the Hotel and Tourism sector, the upcoming spring tourist season and government initiatives to boost tourism could provide some relief. However, investors will be closely monitoring company earnings reports, occupancy rates, and global travel trends before making significant commitments to tourism stocks.

As the market moves forward, investor confidence, liquidity flow, and external economic influences will play a pivotal role in shaping NEPSE’s trajectory. Traders and stakeholders will need to remain vigilant and responsive to changes in both domestic and international market conditions.