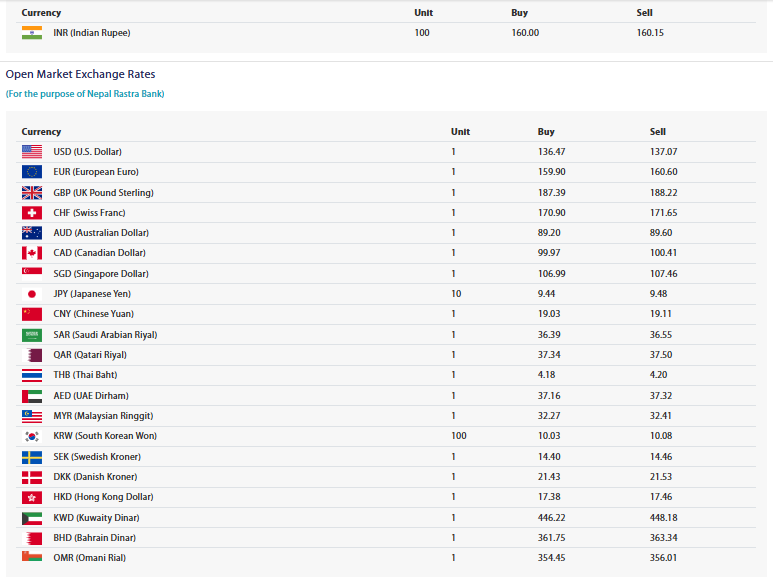

Nepal Rastra Bank (NRB), the country’s central financial authority, has released the latest foreign exchange rates for today. These rates apply to commercial banks, foreign currency exchange, and other regulated financial institutions operating in Nepal. The exchange rate figures show slight fluctuations compared to previous days, reflecting ongoing global currency trends.

Dollar Exchange Rates Slightly Adjusted

According to NRB, the buying rate for 1 US Dollar (USD) has been set at Rs. 136.47, while the selling rate stands at Rs. 137.07. The US dollar remains one of the most actively traded currencies in Nepal, used widely for trade, remittance, and tourism transactions. This slight adjustment reflects global foreign exchange market movements and is part of NRB’s daily monetary policy operation to maintain economic stability and foreign reserve alignment.

European and British Currencies Maintain Strong Value

The Euro (EUR) continues to show a strong position, with the central bank setting the buying rate at Rs. 159.90 and the selling rate at Rs. 160.60. Similarly, the British Pound Sterling (GBP) has a buying rate of Rs. 187.39 and a selling rate of Rs. 188.22, reflecting its high value and consistent strength in the international market. The rates indicate a favorable condition for exporters dealing with European and UK-based markets, though importers may feel the pinch of a stronger foreign currency.

Stability in Regional and Asian Currencies

The Chinese Yuan (CNY) is trading at Rs. 19.03 (buying) and Rs. 19.11 (selling). Meanwhile, Japanese Yen (JPY) is valued at Rs. 9.44 (buying) per 10 units and Rs. 9.48 (selling), offering relatively consistent figures from past weeks.

In South Asia and the Middle East, the Saudi Riyal (SAR) stands at Rs. 36.39 (buying) and Rs. 36.55 (selling), and the Qatari Riyal (QAR) at Rs. 37.34 (buying) and Rs. 37.50 (selling). The Indian Rupee (INR) is pegged at Rs. 160.00 (buying) and Rs. 160.15 (selling) per 100 units, maintaining its traditional semi-fixed range with Nepalese currency due to the long-standing currency mechanism between the two countries.

Other Major Currencies and Their Rates

Among other significant currencies, the Swiss Franc (CHF) is valued at Rs. 170.90 (buying) and Rs. 171.65 (selling). The Australian Dollar (AUD) is available at Rs. 89.20 (buying) and Rs. 89.60 (selling), while the Canadian Dollar (CAD) trades at Rs. 99.97 (buying) and Rs. 100.41 (selling). Singapore Dollar (SGD) rates were also adjusted slightly, with the buying rate at Rs. 106.99 and the selling rate at Rs. 107.46, reflecting changes in Southeast Asia’s financial ecosystem.

Middle Eastern and Gulf Currencies Reflect Strong Standing

For Nepalese workers in the Gulf region, the currency rates of countries like Kuwait, Bahrain, Oman, and the UAE are of particular interest. The Kuwaiti Dinar (KWD), one of the world’s most valuable currencies, is listed at Rs. 446.22 (buying) and Rs. 448.18 (selling). Similarly, the Bahraini Dinar (BHD) is priced at Rs. 361.75 (buying) and Rs. 363.34 (selling), while the Omani Riyal (OMR) is being traded at Rs. 354.45 (buying) and Rs. 356.01 (selling). These high rates benefit remittance inflows and help boost the national reserve, especially given Nepal’s heavy reliance on overseas labor remittances.

Other Currency Updates: Hong Kong, Malaysia, South Korea, Thailand, and Scandinavia

The Hong Kong Dollar (HKD) is being traded at Rs. 17.38 (buying) and Rs. 17.46 (selling), while Malaysian Ringgit (MYR) rates are Rs. 32.27 (buying) and Rs. 32.41 (selling). These figures are particularly relevant for migrant workers and students residing in East and Southeast Asia.

South Korean Won (KRW) per 100 units is priced at Rs. 10.03 (buying) and Rs. 10.08 (selling). In Scandinavia, the Swedish Krona (SEK) is valued at Rs. 14.40 (buying) and Rs. 14.46 (selling), while the Danish Krone (DKK) is listed at Rs. 21.43 (buying) and Rs. 21.53 (selling). The Thai Baht (THB) is also included, with a buying rate of Rs. 4.18 and a selling rate of Rs. 4.20, a stable value for the popular tourist and business destination.

NRB’s Role in Exchange Rate Management

Nepal Rastra Bank clarified that these exchange rates are indicative rates provided by the central bank and can be revised as needed, depending on global currency fluctuations and domestic financial needs. It also noted that commercial banks may quote slightly different rates, which are subject to market dynamics and institutional preferences.

NRB regularly updates these rates on its official website and encourages businesses, travelers, remittance receivers, and other stakeholders to refer to official channels for accurate information.

Today’s exchange rate release by Nepal Rastra Bank highlights Nepal’s connection with global financial markets. With a high dependence on remittance and imports, currency valuation plays a significant role in shaping economic activity. Whether for trade, travel, or remittance, staying informed on exchange rate movements is crucial for financial planning and risk management.