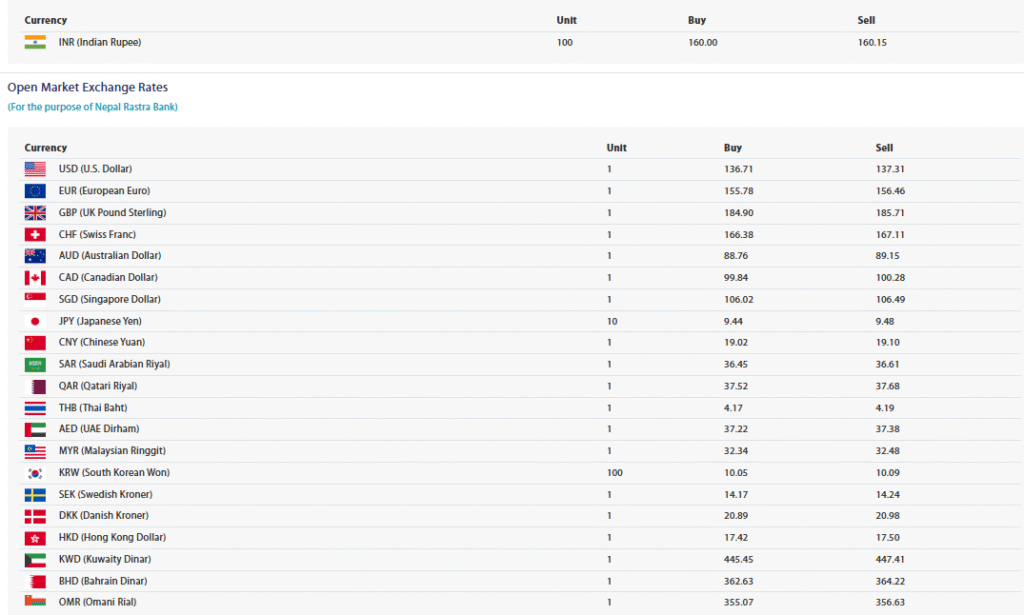

Nepal Rastra Bank (NRB) has officially released the foreign exchange rates for June 9, 2025, outlining the buying and selling rates for various international currencies. These exchange rates are critical for travelers, importers, exporters, and financial institutions engaged in foreign trade and remittance services. The bank has also made it clear that these rates are subject to revision as per market demands and that the rates set by commercial banks may vary accordingly.

USD Exchange Rate Crosses Rs. 137 Mark

The most significant currency for international transactions, the US Dollar, has been pegged at Rs. 136.71 for buying and Rs. 137.31 for selling. This slight rise continues a steady upward trend seen in the past few weeks, reflecting the dollar’s strength globally. Businesses involved in imports and exports, as well as the tourism sector that heavily relies on dollar transactions, are expected to closely monitor such fluctuations.

Euro, Pound Sterling, and Swiss Franc Remain Strong

According to NRB, the European Euro is set at Rs. 155.78 for buying and Rs. 156.46 for selling. Likewise, the UK Pound Sterling, another key currency in global trade, stands at Rs. 184.90 for buying and Rs. 185.71 for selling. The Swiss Franc, often considered a stable global currency, has also maintained strength with a buying rate of Rs. 166.38 and a selling rate of Rs. 167.11. These robust rates indicate the comparative strengthening of European currencies, which could influence foreign travel plans for Nepali citizens and impact the cost of importing European goods.

Regional Currencies: Yuan, Yen, and INR Outlook

In the context of Asia, Japanese Yen per 10 units is valued at Rs. 9.44 for buying and Rs. 9.48 for selling. The Chinese Yuan is pegged at Rs. 19.02 (buying) and Rs. 19.10 (selling), demonstrating marginal stability. The most closely watched, Indian Rupee, is set at Rs. 160.00 for buying per 100 units, while the selling rate is Rs. 160.15. Given Nepal’s extensive trade ties and open border with India, the INR rate directly affects day-to-day commerce and household goods pricing.

Middle Eastern Currencies: Steady Rates Amidst Economic Activity

Catering to the large number of Nepali migrant workers in the Gulf region, the central bank has set the Saudi Arabian Riyal at Rs. 36.45 (buying) and Rs. 36.61 (selling), while the Qatari Riyal is at Rs. 37.52 (buying) and Rs. 37.68 (selling). The UAE Dirham stands at Rs. 37.22 (buying) and Rs. 37.38 (selling).

Additionally, Kuwaiti Dinar – the highest-valued currency listed – is set at Rs. 445.45 (buying) and Rs. 447.41 (selling). Bahraini Dinar stands at Rs. 362.63 (buying) and Rs. 364.22 (selling), while the Omani Riyal is valued at Rs. 355.07 (buying) and Rs. 356.63 (selling). These rates play a significant role in the remittance economy of Nepal, with thousands of families relying on income sent from Gulf countries.

Dollar Bloc Currencies: Australian, Canadian, and Singapore Dollars

Among the dollar-bloc currencies, the Australian Dollar is set at Rs. 88.76 for buying and Rs. 89.15 for selling, while the Canadian Dollar has been valued at Rs. 99.84 for buying and Rs. 100.28 for selling. Similarly, the Singapore Dollar rate is Rs. 106.02 (buying) and Rs. 106.49 (selling). These currencies have a growing significance for Nepal’s trade and travel relations with countries in the Asia-Pacific region.

Other Asian Currencies: Malaysia, Thailand, South Korea

The Malaysian Ringgit stands at Rs. 32.34 (buying) and Rs. 32.48 (selling), while the Thai Baht is pegged at Rs. 4.17 (buying) and Rs. 4.19 (selling). South Korea’s Won, calculated per 100 units, is set at Rs. 10.05 for buying and Rs. 10.09 for selling. These currencies are vital for workers, students, and tourists traveling from Nepal to Southeast and East Asian countries.

Scandinavian and East Asian Markets: Exchange Rates Hold Steady

From Europe, the Swedish Krona is valued at Rs. 14.17 (buying) and Rs. 14.24 (selling). Similarly, the Danish Krone is pegged at Rs. 20.89 (buying) and Rs. 20.98 (selling). Meanwhile, Hong Kong Dollar is being traded at Rs. 17.42 for buying and Rs. 17.50 for selling, reflecting steady economic engagements between Nepal and Hong Kong, especially in trade and tourism.

Flexible Policy and Market Dependency

Nepal Rastra Bank has clarified that the exchange rates announced are indicative and may be adjusted as necessary, based on real-time market conditions. Furthermore, it emphasized that commercial banks might have their own exchange rates depending on operational demands and customer needs. The public and financial institutions are advised to consult the official NRB website for the most current updates.

In a country like Nepal, where remittance contributes significantly to the national GDP and tourism relies on international transactions, daily exchange rates not only reflect market health but also guide strategic financial decisions at both micro and macroeconomic levels.

The currency exchange rates issued by the Nepal Rastra Bank serve as a daily financial compass for businesses, travelers, students, and remittance recipients. In the current economic environment, where the strength of the dollar and regional currencies is being closely watched, such updates are critical for maintaining economic stability and informed decision-making.