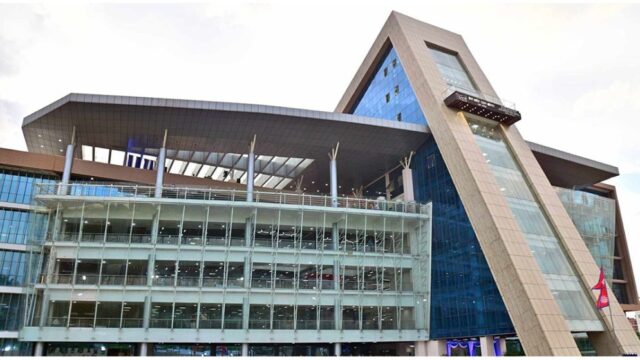

The Nepal Rastra Bank (NRB), the central monetary authority of the country, has published the official foreign exchange rates for today, highlighting the buying and selling rates of major international currencies. These rates are crucial for individuals, travelers, importers, and businesses engaging in foreign transactions.

According to the data released by NRB, the exchange rate for one US Dollar (USD) is set at Rs. 135.91 for buying and Rs. 136.51 for selling. The US Dollar continues to hold a strong position in Nepal’s currency market, reflecting global market trends and the high demand for the dollar in trade and remittances.

Similarly, the Euro (EUR), one of the widely used currencies globally, is valued at Rs. 156.70 for buying and Rs. 157.39 for selling. The British Pound Sterling (GBP) stands higher at Rs. 181.93 for buying and Rs. 182.73 for selling, indicating its relatively strong position against the Nepali Rupee.

Other major currencies have also seen updated rates. The Swiss Franc (CHF) has been fixed at Rs. 168.45 for buying and Rs. 169.19 for selling, maintaining its reputation as a stable global currency.

Among the dollar-pegged currencies, the Australian Dollar (AUD) is being traded at Rs. 87.27 (buying) and Rs. 87.66 (selling), while the Canadian Dollar (CAD) is listed at Rs. 98.39 (buying) and Rs. 98.73 (selling). The Singapore Dollar (SGD), often used in regional business transactions, is now set at Rs. 104.21 (buying) and Rs. 104.67 (selling).

Asian currencies, which hold significance due to Nepal’s trading partners and labor migration, have also been listed with updated values. The Japanese Yen (JPY) is valued at Rs. 9.65 for 10 yen (buying) and Rs. 9.69 (selling). Meanwhile, the Chinese Yuan (CNY), a key currency for trade with China, is being traded at Rs. 18.64 (buying) and Rs. 18.73 (selling).

In the Gulf region, where many Nepali migrant workers are employed, currencies such as the Saudi Arabian Riyal (SAR) and the Qatari Riyal (QAR) have also been updated. The SAR is fixed at Rs. 36.23 (buying) and Rs. 36.39 (selling), while the QAR stands at Rs. 37.28 (buying) and Rs. 37.45 (selling).

Other regional currencies include the Thai Baht (THB), which is valued at Rs. 4.11 (buying) and Rs. 4.12 (selling). The UAE Dirham (AED) is set at Rs. 37.00 (buying) and Rs. 37.17 (selling). The Malaysian Ringgit (MYR) is trading at Rs. 31.10 (buying) and Rs. 31.24 (selling), while 100 South Korean Won (KRW) are worth Rs. 9.57 (buying) and Rs. 9.62 (selling).

The Swedish Krona (SEK) is listed at Rs. 14.30 (buying) and Rs. 14.36 (selling), and the Danish Krone (DKK) is valued at Rs. 20.99 (buying) and Rs. 21.08 (selling).

Among other important currencies, the Hong Kong Dollar (HKD) is now traded at Rs. 17.51 (buying) and Rs. 17.59 (selling). The Kuwaiti Dinar (KWD), known for its high value globally, stands at Rs. 444.06 for buying and Rs. 446.02 for selling the highest among the listed currencies.

Similarly, the Bahraini Dinar (BHD) is being exchanged at Rs. 360.57 (buying) and Rs. 362.16 (selling), while the Omani Riyal (OMR) has been fixed at Rs. 353.02 (buying) and Rs. 354.58 (selling).

Closer to home, the Indian Rupee (INR), which has a fixed pegged exchange rate with the Nepali Rupee, continues to be traded at Rs. 160 per 100 Indian Rupees for buying, and Rs. 160.15 for selling. This fixed rate ensures currency stability for cross-border trade and financial transactions with India.

The Nepal Rastra Bank also clarified that these rates are indicative and subject to change at any time based on market dynamics. The central bank has the authority to revise the exchange rates as needed. It also informed that the commercial banks operating within the country might quote slightly different rates due to competitive market factors and service charges.

Furthermore, the most up-to-date exchange rates are available on the official website of the Nepal Rastra Bank. The institution regularly updates the data to help businesses, financial institutions, and the public stay informed about the latest foreign exchange trends.

As foreign exchange rates continue to influence the cost of imports, remittance flow, and tourism earnings, stakeholders closely monitor these daily updates. With a globally interconnected economy, the fluctuation in major currencies has a direct impact on Nepal’s financial planning and economic outlook.

In summary, today’s foreign exchange update from the Nepal Rastra Bank provides a comprehensive overview of the prevailing currency rates, offering a reference point for those dealing with international transactions. The central bank’s transparent disclosure plays a pivotal role in ensuring stability and predictability in Nepal’s monetary system.

The Nepal Rastra Bank (NRB), the central monetary authority of the country, has published the official foreign exchange rates for today, highlighting the buying and selling rates of major international currencies. These rates are crucial for individuals, travelers, importers, and businesses engaging in foreign transactions.

According to the data released by NRB, the exchange rate for one US Dollar (USD) is set at Rs. 135.91 for buying and Rs. 136.51 for selling. The US Dollar continues to hold a strong position in Nepal’s currency market, reflecting global market trends and the high demand for the dollar in trade and remittances.

Similarly, the Euro (EUR), one of the widely used currencies globally, is valued at Rs. 156.70 for buying and Rs. 157.39 for selling. The British Pound Sterling (GBP) stands higher at Rs. 181.93 for buying and Rs. 182.73 for selling, indicating its relatively strong position against the Nepali Rupee.

Other major currencies have also seen updated rates. The Swiss Franc (CHF) has been fixed at Rs. 168.45 for buying and Rs. 169.19 for selling, maintaining its reputation as a stable global currency.

Among the dollar-pegged currencies, the Australian Dollar (AUD) is being traded at Rs. 87.27 (buying) and Rs. 87.66 (selling), while the Canadian Dollar (CAD) is listed at Rs. 98.39 (buying) and Rs. 98.73 (selling). The Singapore Dollar (SGD), often used in regional business transactions, is now set at Rs. 104.21 (buying) and Rs. 104.67 (selling).

Asian currencies, which hold significance due to Nepal’s trading partners and labor migration, have also been listed with updated values. The Japanese Yen (JPY) is valued at Rs. 9.65 for 10 yen (buying) and Rs. 9.69 (selling). Meanwhile, the Chinese Yuan (CNY), a key currency for trade with China, is being traded at Rs. 18.64 (buying) and Rs. 18.73 (selling).

In the Gulf region, where many Nepali migrant workers are employed, currencies such as the Saudi Arabian Riyal (SAR) and the Qatari Riyal (QAR) have also been updated. The SAR is fixed at Rs. 36.23 (buying) and Rs. 36.39 (selling), while the QAR stands at Rs. 37.28 (buying) and Rs. 37.45 (selling).

Other regional currencies include the Thai Baht (THB), which is valued at Rs. 4.11 (buying) and Rs. 4.12 (selling). The UAE Dirham (AED) is set at Rs. 37.00 (buying) and Rs. 37.17 (selling). The Malaysian Ringgit (MYR) is trading at Rs. 31.10 (buying) and Rs. 31.24 (selling), while 100 South Korean Won (KRW) are worth Rs. 9.57 (buying) and Rs. 9.62 (selling).

The Swedish Krona (SEK) is listed at Rs. 14.30 (buying) and Rs. 14.36 (selling), and the Danish Krone (DKK) is valued at Rs. 20.99 (buying) and Rs. 21.08 (selling).

Among other important currencies, the Hong Kong Dollar (HKD) is now traded at Rs. 17.51 (buying) and Rs. 17.59 (selling). The Kuwaiti Dinar (KWD), known for its high value globally, stands at Rs. 444.06 for buying and Rs. 446.02 for selling the highest among the listed currencies.

Similarly, the Bahraini Dinar (BHD) is being exchanged at Rs. 360.57 (buying) and Rs. 362.16 (selling), while the Omani Riyal (OMR) has been fixed at Rs. 353.02 (buying) and Rs. 354.58 (selling).

Closer to home, the Indian Rupee (INR), which has a fixed pegged exchange rate with the Nepali Rupee, continues to be traded at Rs. 160 per 100 Indian Rupees for buying, and Rs. 160.15 for selling. This fixed rate ensures currency stability for cross-border trade and financial transactions with India.

The Nepal Rastra Bank also clarified that these rates are indicative and subject to change at any time based on market dynamics. The central bank has the authority to revise the exchange rates as needed. It also informed that the commercial banks operating within the country might quote slightly different rates due to competitive market factors and service charges.

Furthermore, the most up-to-date exchange rates are available on the official website of the Nepal Rastra Bank. The institution regularly updates the data to help businesses, financial institutions, and the public stay informed about the latest foreign exchange trends.

As foreign exchange rates continue to influence the cost of imports, remittance flow, and tourism earnings, stakeholders closely monitor these daily updates. With a globally interconnected economy, the fluctuation in major currencies has a direct impact on Nepal’s financial planning and economic outlook.

In summary, today’s foreign exchange update from the Nepal Rastra Bank provides a comprehensive overview of the prevailing currency rates, offering a reference point for those dealing with international transactions. The central bank’s transparent disclosure plays a pivotal role in ensuring stability and predictability in Nepal’s monetary system.