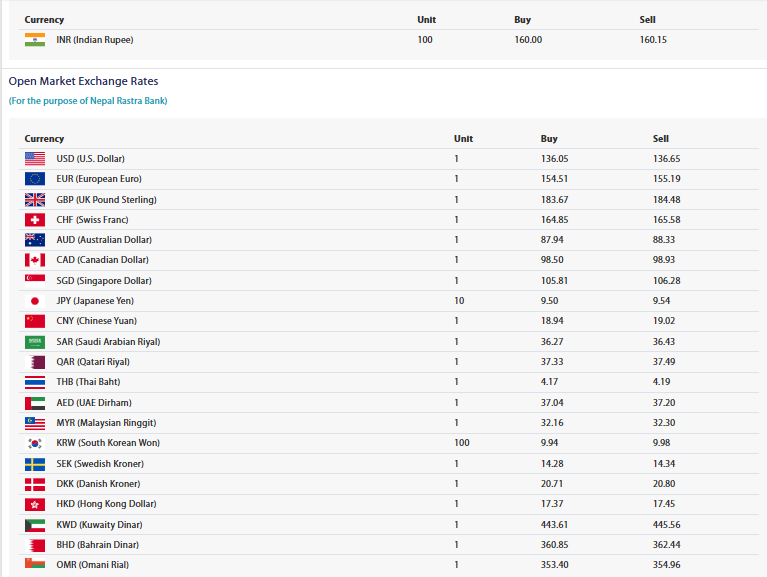

Nepal Rastra Bank (NRB), the central monetary authority of Nepal, has released the official foreign exchange rates for May 25, 2025. The updated rates determine the buying and selling prices for major global currencies and provide guidance for foreign trade, tourism, remittances, and other financial transactions involving foreign currency.

Nepal Rastra Bank’s Exchange Rate

According to the data published by NRB, the exchange rate of the US Dollar (USD) for today stands at Rs. 136.05 for buying and Rs. 136.65 for selling. The US Dollar remains one of the most crucial foreign currencies for Nepal due to its extensive use in international trade and remittances.

In the European currency segment, the Euro (EUR) has a buying rate of Rs. 154.51 and a selling rate of Rs. 155.19, while the British Pound Sterling (GBP) is trading at Rs. 183.67 for buying and Rs. 184.48 for selling. The Swiss Franc (CHF) is being exchanged at Rs. 164.85 (buying) and Rs. 165.58 (selling).

Among major Commonwealth currencies, the Australian Dollar (AUD) has been fixed at Rs. 87.94 for buying and Rs. 88.33 for selling, and the Canadian Dollar (CAD) is set at Rs. 98.50 (buying) and Rs. 98.93 (selling). Similarly, the Singapore Dollar (SGD) is pegged at Rs. 105.81 for buying and Rs. 106.28 for selling.

In the Asian currency group, the Japanese Yen (JPY) quoted for 10 units has a buying rate of Rs. 9.50 and a selling rate of Rs. 9.54. The Chinese Yuan (CNY) is trading at Rs. 18.94 for buying and Rs. 19.02 for selling, reflecting the growing trade ties between Nepal and China.

From the Middle East region, widely used currencies for remittance inflow are also included in today’s rates. The Saudi Arabian Riyal (SAR) stands at Rs. 36.27 (buying) and Rs. 36.43 (selling), and the Qatari Riyal (QAR) is being exchanged at Rs. 37.33 for buying and Rs. 37.49 for selling.

Further, the UAE Dirham (AED) has a buying rate of Rs. 37.04 and a selling rate of Rs. 37.20, while the Thai Baht (THB) is traded at Rs. 4.17 for buying and Rs. 4.19 for selling. These currencies are especially significant given Nepal’s large migrant labor force residing in these countries.

The Malaysian Ringgit (MYR) is pegged at Rs. 32.16 (buying) and Rs. 32.30 (selling), while 100 South Korean Won (KRW) are valued at Rs. 9.94 for buying and Rs. 9.98 for selling.

Scandinavian currencies have also seen updates in their rates. The Swedish Krona (SEK) is being traded at Rs. 14.28 for buying and Rs. 14.34 for selling, while the Danish Krone (DKK) has a buying rate of Rs. 20.71 and a selling rate of Rs. 20.80.

In East Asia, the Hong Kong Dollar (HKD) is currently valued at Rs. 17.37 for buying and Rs. 17.45 for selling. Among the highest-valued currencies listed, the Kuwaiti Dinar (KWD) stands at Rs. 443.61 for buying and Rs. 445.56 for selling. Likewise, the Bahraini Dinar (BHD) has a buying rate of Rs. 360.85 and a selling rate of Rs. 362.44, and the Omani Riyal (OMR) is being exchanged at Rs. 353.40 for buying and Rs. 354.96 for selling.

The exchange rate for the Indian Rupee (INR), which is critical for daily financial transactions in Nepal due to geographic and economic proximity, is set at Rs. 160.00 for buying and Rs. 160.15 for selling for every 100 Indian Rupees.

Nepal Rastra Bank has clarified that these rates are indicative mid-rates and can be revised at any time depending on global financial trends and currency demand. It has also been advised that the commercial banks may quote different exchange rates based on supply and demand dynamics and their internal policies.

The central bank’s daily publication of foreign exchange rates helps maintain transparency, consistency, and stability in the financial system and aids in regulating cross-border transactions. The real-time rates are available on the NRB’s official website, which is updated regularly to reflect any market fluctuations.

These rates are particularly important for sectors like import-export businesses, tourism, remittance services, and foreign currency account holders, ensuring that all stakeholders remain informed of current conversion values when conducting transactions.

With foreign exchange being a significant pillar in Nepal’s economy, especially due to remittances contributing a large share of GDP, the role of Nepal Rastra Bank in maintaining exchange rate stability is crucial.