The Nepal Stock Exchange (NEPSE) Index recorded a notable dip in today’s trading session, closing the day with a loss of 11.06 points or 0.41%, bringing the benchmark index down to 2,629.89 points. This decline comes on the heels of a 5.99-point drop in the previous session, marking two consecutive days of downward movement in the domestic equities market.

The trading day began with the index opening at 2,639.27, reaching an intraday high of 2,645.22, before sliding to a low of 2,626.39. Despite the dip in the index, the market remained active, with total turnover reaching Rs. 9.13 Arba. A total of 19,992,181 shares were traded across 313 listed companies, processed through 86,636 transactions.

The overall market capitalization stood at Rs. 43.80 Kharba, with the float market capitalization recorded at Rs. 14.75 Kharba, indicating a minor contraction in investor wealth as a result of the day’s bearish sentiment.

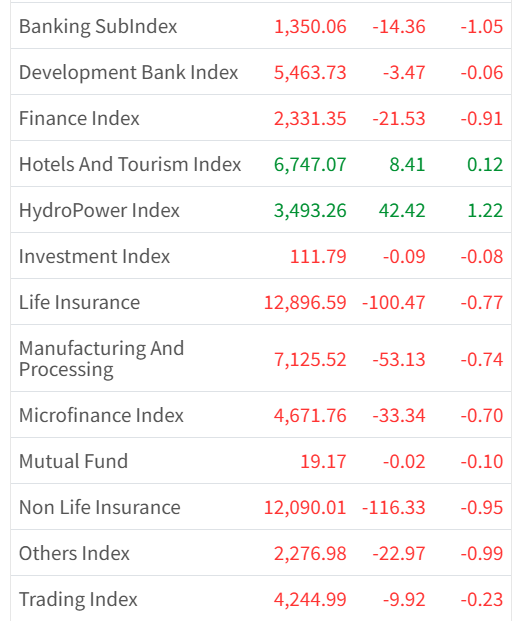

Sector Focus: Hotels and Tourism Index Shows Modest Rebound

Amidst the general decline in the broader market, the Hotels and Tourism Index provided a glimmer of optimism. After a significant drop of 32.80 points in the previous session, the index managed to register a marginal gain of 8.41 points or 0.12%, closing at 6,747.07 points.

The sub-index, which represents the hospitality and tourism sectors, opened at 6,738.66, climbing to an intraday high of 6,812.51 before slipping to the day’s low of 6,715.28. The modest uptick in this sector suggests investor confidence may be stabilizing following a sharp correction earlier in the week. This resilience could be attributed to ongoing optimism surrounding the post-pandemic recovery of Nepal’s tourism industry, with increased footfalls in major destinations and rising hotel occupancy rates.

Market Sentiment and Outlook

Despite strong trading volumes and sustained investor engagement, the NEPSE index failed to maintain upward momentum amid continued market corrections. Analysts suggest that ongoing profit-booking activity, especially in heavyweight sectors such as banking and hydropower, could be contributing to the pullback. Additionally, macroeconomic uncertainties and fluctuating liquidity levels in the banking system may also be affecting investor sentiment.

Nevertheless, some sectors, such as hotels and tourism, appear to be finding renewed interest. The tourism sector’s performance, particularly in companies with strong fundamentals and expansion strategies, continues to attract selective buying. The rebound in the Hotels and Tourism Index could signal a short-term sectoral rotation, with investors eyeing value in sectors expected to benefit from seasonal demand and improving economic conditions.

Today’s decline in the NEPSE index reflects a cautious market tone amid ongoing fluctuations in investor sentiment. While the broader index continues to struggle with sustaining gains, the Hotels and Tourism sector’s slight recovery indicates pockets of resilience in the market.

Investors are advised to monitor sectoral trends and remain updated on market-moving developments as the market seeks a stable footing after recent volatility. As always, diversification and a long-term investment strategy remain key in navigating the current equity landscape.