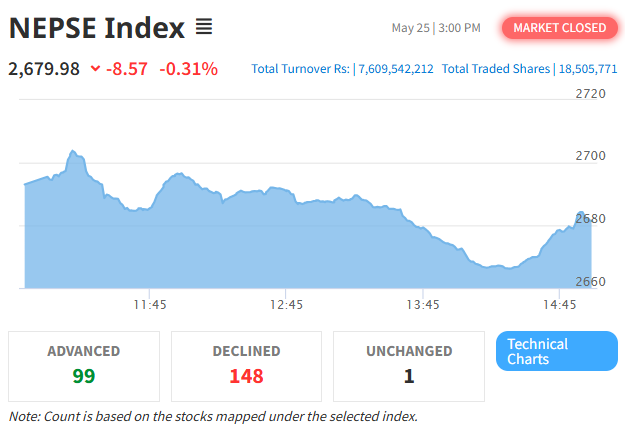

The Nepal Stock Exchange (NEPSE) witnessed a decline in trading today, shedding 8.57 points or 0.31%, bringing the benchmark index down to 2,679.98 points. This drop comes after a brief gain of 19.04 points in the previous trading session, indicating continued volatility in the market.

The day started with the NEPSE index opening at 2,693.04 points. During trading hours, it touched an intraday high of 2,703.78 and dipped to a low of 2,665.48. The market displayed a mixed trend, fluctuating between gains and losses before closing in the red.

A total of 18,505,771 shares were traded throughout the session, spanning 314 listed companies. These transactions were executed through 70,610 deals, amounting to a daily turnover of Rs. 7.60 Arba. Despite the decline, the market remained fairly active, with investor participation remaining strong.

At the end of today’s session, the overall market capitalization stood at Rs. 44.59 Kharba, while the float market capitalization was recorded at Rs. 15.03 Kharba. This reflects a minor contraction in market value, driven primarily by declines in several key sectors.

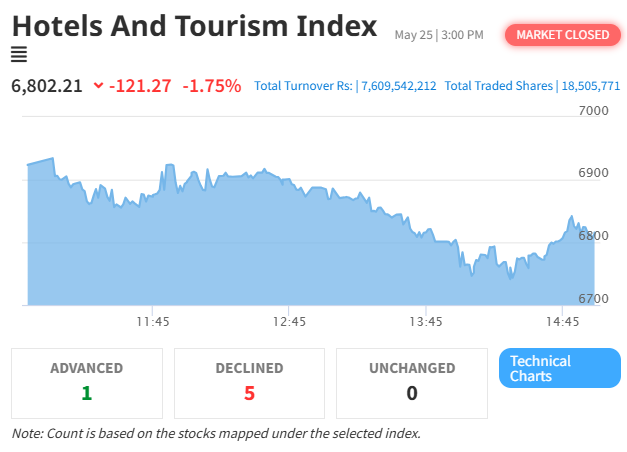

Among the various sectoral indices, the Hotel and Tourism Index notably continued its downward momentum. The index fell by 121.27 points or 1.75%, settling at 6,802.21 points. This comes on the heels of a 185.11-point loss recorded in the previous session, extending the sector’s weekly downturn.

NEPSE Index

The Hotel and Tourism Index opened today’s session at 6,923.49 points and reached a high of 6,934.21 before falling to a low of 6,740.60. The drop suggests continued investor caution in this segment, which is often influenced by tourism trends, hospitality earnings, and seasonal demand patterns.

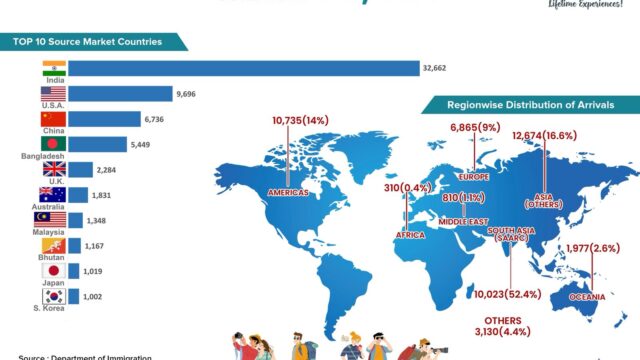

Market analysts attribute today’s decline to a combination of profit booking, cautious investor sentiment, and sector-specific corrections. The hotel and tourism sector, in particular, appears to be undergoing a price adjustment after a period of rapid growth and renewed optimism following tourism recovery efforts earlier in the year.

While some sectors showed signs of stability, the decline in the Hotel and Tourism Index is being closely monitored due to its close correlation with Nepal’s economic outlook, especially as the country promotes itself as a post-pandemic tourist destination. The repeated losses suggest that investors may be reassessing short-term growth expectations in the hospitality segment.

Despite the fall in the index, overall market turnover remained relatively strong, indicating that there is still active participation from retail and institutional investors. The volatility seen in recent sessions could be a sign of sectoral rotation, where investors shift their focus from overbought sectors to undervalued ones.

Looking ahead, traders and analysts expect the market to remain sensitive to economic indicators, political developments, and global cues. With several companies set to release quarterly earnings and dividends in the coming weeks, market activity may pick up further, offering potential recovery opportunities for sectors like tourism and hospitality.

NEPSE closed in negative territory today after a promising start, reflecting investor indecision and sector-specific pressure. The continued slump in the Hotel and Tourism Index stands out as a key concern, and market watchers will be paying close attention to whether this trend persists or stabilizes in upcoming sessions.