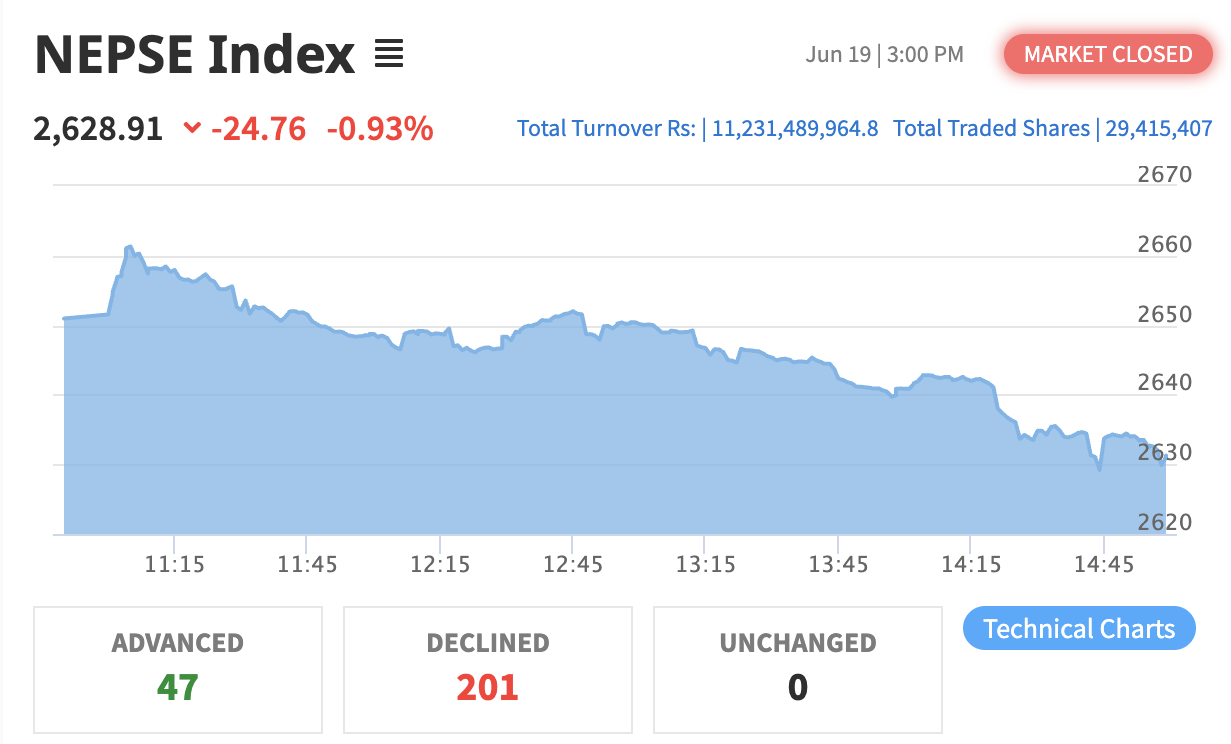

The Nepal Stock Exchange (NEPSE) index recorded a significant decline today, falling by 24.76 points, or 0.93%, to close at 2,628.91. This marks a sharper loss compared to the previous trading session, which had witnessed a marginal drop of 1.07 points.

The trading day began with the NEPSE index opening at 2,650.96. Despite briefly climbing to an intraday high of 2,661.33, the market was unable to maintain momentum and dropped to an intraday low of 2,628.27, where it eventually settled. The sentiment across the market remained largely bearish.

Trading Volume and Market Capitalization

Today’s market recorded a robust total turnover of Rs. 11.23 Arba, with a total of 29,415,407 shares traded. These transactions were spread across 314 listed companies, carried out through 121,551 trades, reflecting a high level of investor activity despite the downward trend in the index.

As a result of the decline, market capitalization stood at Rs. 43.79 Kharba, while the float market capitalization was recorded at Rs. 14.78 Kharba, indicating a reduction in overall investor wealth and market value.

Hotel and Tourism Sector Extends Losses

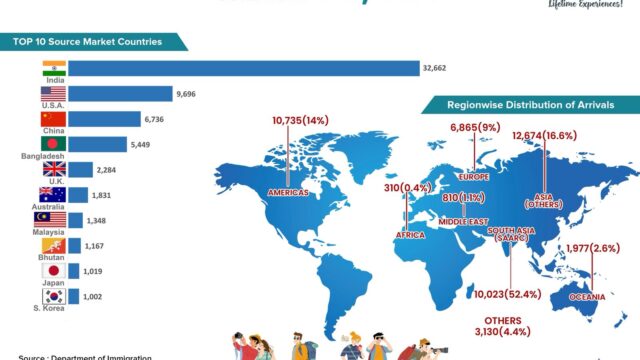

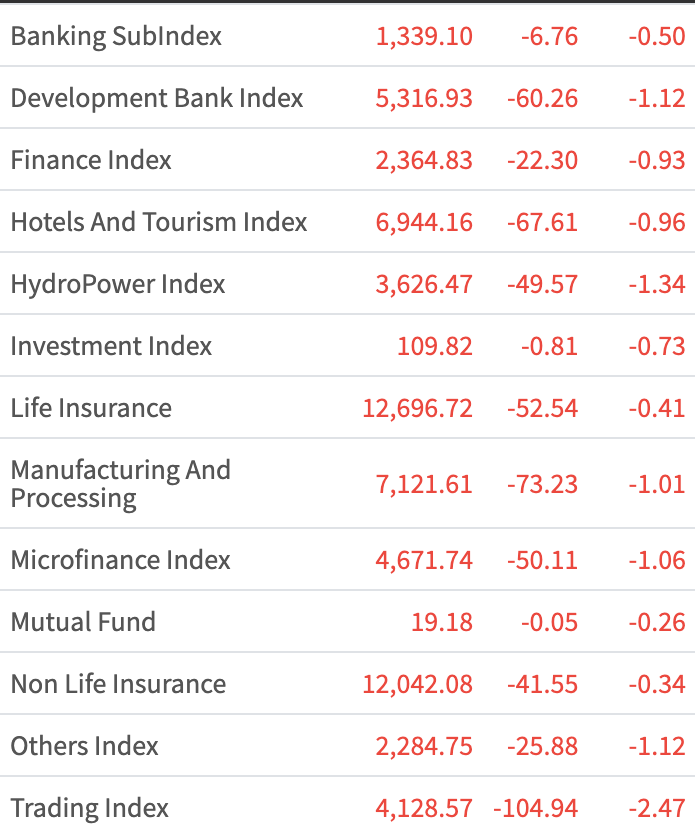

Among the various sectoral indices, the Hotel and Tourism Index experienced a notable loss for the second consecutive trading session. It fell by 67.61 points, or 0.96%, to close at 6,944.16. This follows an even steeper loss of 80.57 points in the previous session, signaling continued investor skepticism in the sector.

The Hotel and Tourism Index opened at 6,997.13, briefly surged to an intraday high of 7,078.23, but later fell to an intraday low of 6,894.30, reflecting a volatile and downward trading pattern. The sustained decline in this index suggests concerns around profitability or external market conditions affecting the tourism and hospitality sector.

Market Outlook

The back-to-back losses in the overall NEPSE index and particularly in the Hotel and Tourism sector suggest a bearish sentiment prevailing in the market. Despite a relatively high trading volume, the consistent drop in key indices may prompt cautious trading in the upcoming sessions.

Analysts suggest that market participants are likely reacting to a mix of domestic economic factors, sector-specific performance, and global cues. The tourism sector, often regarded as a key economic contributor, is currently under pressure, which may be a point of concern for both short-term traders and long-term investors.

As investors await further developments and possible corrective moves in the coming days, close monitoring of macroeconomic indicators and sectoral performance will remain crucial for predicting the near-term direction of the market.