The Nepal Stock Exchange (NEPSE) Index recorded a notable gain in today’s trading session, marking a continuation of positive momentum seen in the previous session. The benchmark index rose by 25.07 points, or 0.94%, closing at 2,678.17 points. This follows Monday’s rise of 23.19 points, signaling improved investor confidence across several sectors, particularly Hotels and Tourism.

NEPSE Surges Amidst Strong Market Sentiment

The market opened at 2,654.31 points and maintained a generally upward trajectory throughout the day. The NEPSE index touched an intraday high of 2,683.25 and a low of 2,653.57, demonstrating relatively low volatility during the session.

Investor participation remained robust. The total turnover stood at Rs. 10.16 Arba, reflecting the heightened trading activity and continued interest from both retail and institutional investors. A total of 23,697,145 shares were exchanged during the day, encompassing 311 listed companies and involving 81,738 transactions.

The total market capitalization reached Rs. 44.60 Kharba, while the float market capitalization, which reflects the value of shares available for public trading, was recorded at Rs. 15.02 Kharba. These figures highlight the increasing strength and scale of Nepal’s equity market, which continues to be an important avenue for investment and wealth creation.

Hotels and Tourism Index Leads Sectoral Recovery

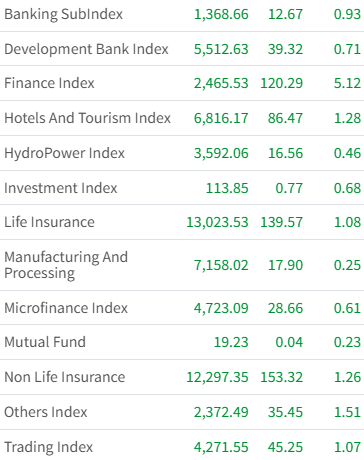

One of the most significant developments in today’s session was the recovery in the Hotels and Tourism sub-index, which saw a gain of 86.47 points (1.28%), settling at 6,816.17 points. This performance marks a strong rebound from the previous day’s 17.37-point decline and reflects renewed optimism in the tourism and hospitality sector.

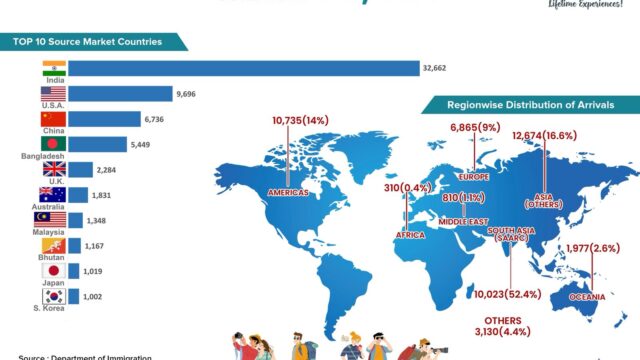

The Hotels and Tourism Index opened the day at 6,729.70, which also marked its intraday low. It steadily climbed to reach an intraday high of 6,854.51, before settling slightly lower by the day’s end. The consistent upward movement through the session indicates renewed investor faith in the sector’s long-term recovery prospects, likely buoyed by ongoing promotional activities and increased tourist footfall in key destinations across Nepal.

Tourism-focused companies, including hotel chains, resort operators, and travel-related enterprises, are expected to benefit from seasonal travel trends and a boost in domestic tourism. This index’s rebound is also being viewed as a leading indicator for the broader economic recovery in the post-pandemic environment.

Market Momentum Driven by Broad-Based Buying

Today’s market activity was characterized by broad-based buying across several key sectors, not just limited to Hotels and Tourism. The increase in the benchmark index also suggests that other indices, such as Banking, Hydropower, and Development Banks, may have witnessed renewed buying interest.

Although specific sector-wise turnover details are awaited, market analysts note that investors are growing increasingly comfortable with current market valuations and are positioning themselves ahead of mid-year financial results. Additionally, with stable macroeconomic indicators and a supportive regulatory environment, the equities market continues to be an attractive option for long-term capital deployment.

Technical Indicators Signal Continued Uptrend

From a technical analysis perspective, the NEPSE’s performance over the past two sessions suggests a potential breakout from its recent consolidation phase. The index closing above 2,670 points is being seen as a positive development, with analysts indicating that the next resistance level lies around 2,700–2,720 points. If this level is breached in upcoming sessions, it could trigger another wave of buying.

However, analysts also caution investors to be mindful of market corrections, especially after consecutive gains. Proper risk management and stock selection remain critical.

Investor Outlook Positive Amid Market Stability

The upward movement in both the NEPSE index and the Hotels and Tourism Index is being interpreted as a sign of increasing investor confidence. The tourism sector’s rebound, supported by rising tourist arrivals, and the overall positive sentiment across sectors reflect a healthy outlook for the Nepali capital market.

With significant interest from retail participants and growing institutional involvement, the NEPSE seems poised to maintain its current momentum, especially if macroeconomic indicators remain supportive. Market watchers are keeping an eye on government policy updates, upcoming corporate earnings, and tourism industry statistics, which could further influence investor behavior in the coming weeks.