The Nepal Stock Exchange (NEPSE) posted a modest rise on Sunday, gaining 2.80 points (0.10%) to close at 2,658.66, building on the slight momentum of the previous session, which saw a minor uptick of 0.47 points.

Market Performance Overview

The benchmark NEPSE index opened the day at 2,652.18, experienced volatility throughout the trading session, reaching an intraday high of 2,679.74, and bottoming at 2,652.13. By the end of the trading day, the total turnover hit an impressive Rs. 13.18 Arba, fueled by the exchange of 33,637,966 shares from 318 listed companies. The market remained active with 105,635 transactions recorded throughout the session.

The overall market capitalization stood at Rs. 44.29 Kharba, while the float market capitalization, which includes only the freely tradable shares, was valued at Rs. 14.93 Kharba.

Hotel and Tourism Index Leads Sectoral Gains

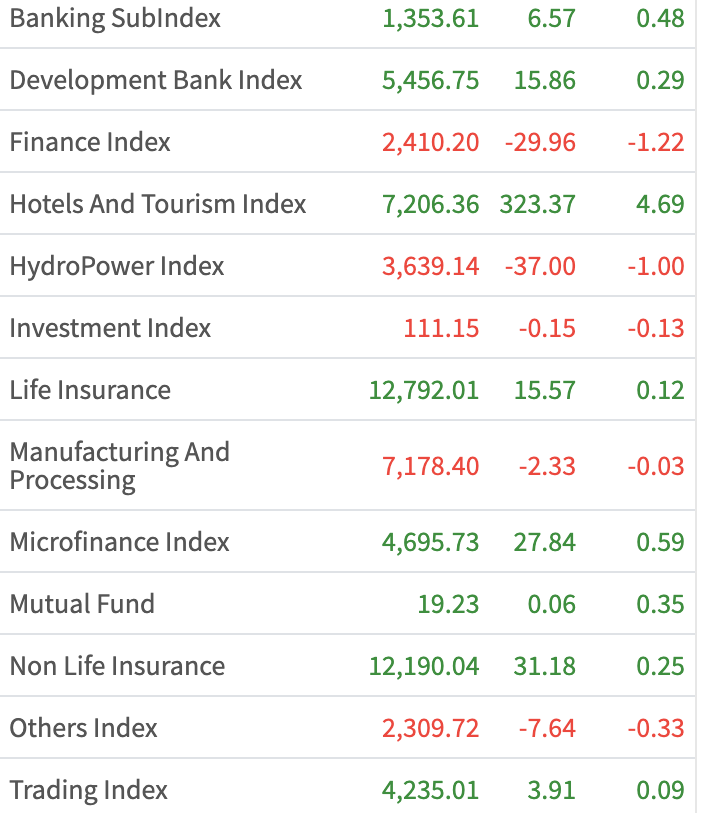

Leading the sectoral performance was the Hotel and Tourism Index, which surged by 323.37 points (4.69%) to settle at 7,206.36. This marks a significant rebound from the previous session, where the index had slipped by 4.38 points. The sector opened the day at 6,882.42, reached a session high of 7,242.33, and touched a low of 6,830.58 before closing with the highest percentage gain among all sectors.

This notable uptick in the Hotel and Tourism Index reflects rising investor confidence in Nepal’s tourism industry, possibly influenced by ongoing government emphasis on tourism infrastructure development and seasonal travel patterns that favor the hospitality sector.

Mixed Sectoral Movement

While the tourism sector led the charge, not all sectors followed the upward trend. The Finance Index registered the largest loss among all sectors, declining by 1.22%, reflecting subdued investor sentiment possibly due to regulatory tightening or profit-booking following earlier gains. Other sectors posted mixed results, with some remaining relatively flat and others showing slight movement, contributing to the NEPSE’s cautious yet positive close.

Outlook

With NEPSE showing signs of consolidation and selective sectoral strength, particularly in the tourism space, the market appears to be in a wait-and-watch mode, balancing investor optimism with macroeconomic uncertainties.

The strong performance of the Hotel and Tourism Index could signal a sector-specific rally in the coming days, especially if backed by favorable policy cues or increased tourist inflow, which often translates to rising hotel bookings and revenue growth. Investors and analysts will be closely monitoring the upcoming sessions to see whether this momentum continues or if volatility resumes amid fluctuating investor sentiment.