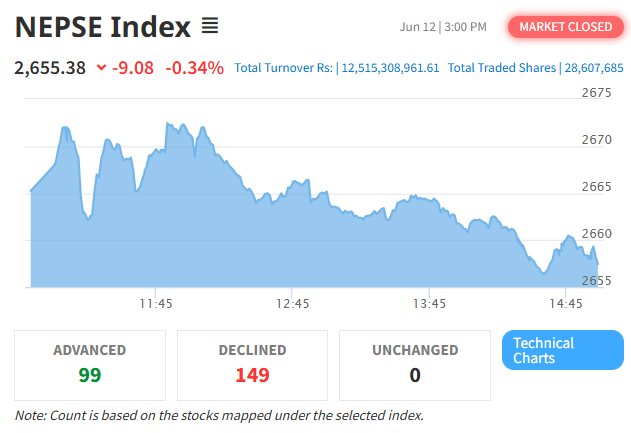

The Nepal Stock Exchange (NEPSE) Index faced another setback today, marking its second consecutive day of decline. The benchmark index closed at 2,655.38 points, down by 9.08 points (0.34%), following yesterday’s loss of 13.69 points. While the broader market struggled, the Hotels and Tourism Index emerged as the day’s standout performer, posting a notable gain.

Market Performance Overview

The market opened at 2,665.23 points, reaching an intraday high of 2,672.42 points before slipping to an intraday low of 2,654.69 points. The overall sentiment remained cautious, with the benchmark showing signs of consolidation amid market uncertainty.

Despite the dip in the index, the market remained active with robust trading volume. A total of 28,607,685 shares were traded across 311 listed companies, generating a turnover of Rs. 12.51 Arba through 1,02,895 transactions.

The market capitalization stood at Rs. 44.23 Kharba, while the float market capitalization, which measures the value of publicly tradable shares, was recorded at Rs. 14.91 Kharba. These figures reflect investor interest even as the broader index struggles for direction.

Hotels and Tourism Index Leads the Gains

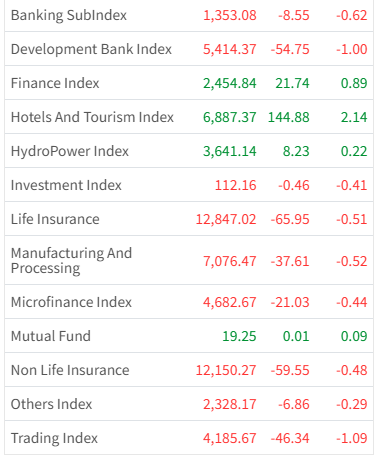

In sharp contrast to the broader market, the Hotels and Tourism Index posted a strong performance, climbing by 144.88 points (2.14%) to settle at 6,887.37 points. This comes after the index suffered a 73.68-point loss in the previous trading session, showing signs of quick recovery and renewed investor confidence in the tourism and hospitality sector.

The Hotels and Tourism Index opened at 6,805.42 points, rose to an intraday high of 6,982.02 points, and fell to a low of 6,734.72 points during the trading session. The sharp movement suggests heightened interest and activity in tourism-related stocks, likely fueled by optimism in post-pandemic travel and increasing hotel occupancy rates.

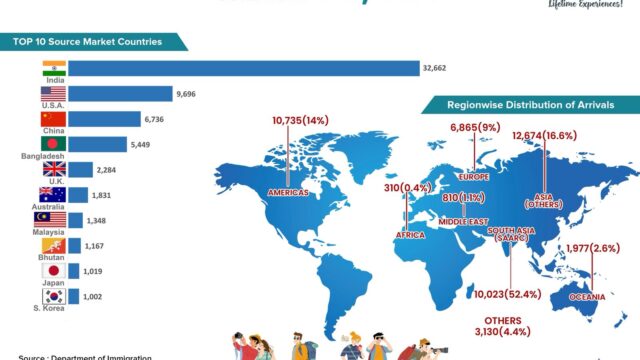

Tourism sector companies, including hotels, resorts, and travel agencies, saw strong investor traction, potentially reflecting market sentiment aligned with Nepal’s growing tourism recovery. With tourism arrivals improving and the government pushing for international promotion of Nepal as a travel destination, investors may be betting on sustained growth in this segment.

Sectoral Breakdown: Mixed Performance

Among the sectoral indices, the Hotels and Tourism Index was the only one to record gains, underlining its standout status for the day. All other indices closed in red, reflecting widespread bearish sentiment across sectors.

The Trading Index posted the highest loss, dropping by 1.09%, indicating weak performance among wholesale and retail trade-based stocks. Other sectors, including Finance, Development Bank, Manufacturing & Processing, and Microfinance, also showed declines, though with varying magnitudes.

The performance divergence between the Hotels and Tourism sector and the rest of the market reflects a sectoral shift in investor focus, where capital is moving toward perceived short- to mid-term growth opportunities amid a cautious market backdrop.

Investor Sentiment and Market Outlook

The current downtrend in NEPSE can be attributed to a combination of profit-booking, cautious sentiment, and macro-economic concerns, including rising interest rates and regulatory tightening. Despite this, the high turnover and volume reflect that liquidity remains strong in the market, suggesting that investors are reallocating rather than exiting entirely.

Market analysts suggest that the Hotels and Tourism sector could continue to perform well, especially during the mid-year travel season and with increasing government focus on tourism revival. However, the overall market may remain volatile in the short term as investors await clarity on fiscal policies and economic indicators.

Today’s trading session on the Nepal Stock Exchange was marked by a minor loss in the benchmark index, continuing the bearish trend from the previous session. However, the Hotels and Tourism sector defied the trend, posting impressive gains and emerging as a bright spot in an otherwise downbeat market. As tourism continues to rebound in Nepal, this sector may continue to attract investor interest, even as broader market uncertainty lingers.

The coming sessions will be crucial in determining whether NEPSE can find stable ground or if further corrections are in store. Investors and analysts alike will be closely monitoring sectoral trends, economic announcements, and global cues in the days ahead.