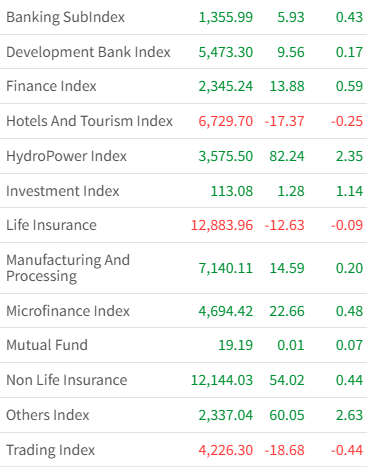

The Nepal Stock Exchange (NEPSE) rebounded today with a notable gain of 23.19 points, marking a 0.88% increase and closing at 2,653.09 points. This comes after the benchmark index had recorded an 11.06-point decline in the previous trading session.

NEPSE Sees Positive Momentum Amid Active Trading

The NEPSE index opened the day at 2,629.23 and moved within a broad range throughout the session, reaching an intraday high of 2,657.34 and a low of 2,627.76. The overall sentiment in the market appeared optimistic as investor participation increased.

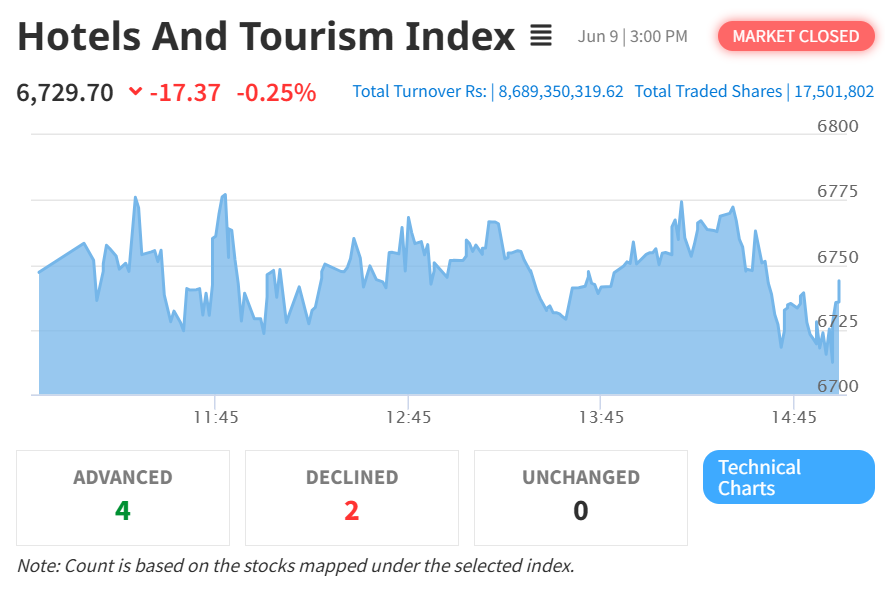

The total turnover for the day stood at Rs. 8.68 Arba, reflecting robust trading activity. A total of 17,501,802 shares were traded during the session, spanning 324 listed companies and conducted through 78,848 transactions. These figures indicate continued confidence among investors across multiple sectors.

In terms of overall valuation, the market capitalization reached Rs. 44.19 Kharba, while the float market capitalization was recorded at Rs. 14.88 Kharba.

This rebound in the benchmark index reflects improved buying interest across various sectors, though some sectors, including Hotels and Tourism, experienced marginal losses.

Hotels and Tourism Index Registers Minor Decline

Contrary to the positive movement in the broader NEPSE index, the Hotels and Tourism Index closed in negative territory, posting a decline of 17.37 points or 0.25%, settling at 6,729.70. This pullback comes after the index had gained 8.41 points in the previous trading session.

The index opened at 6,747.08 and experienced volatility during the session, hitting a high of 6,777.04 and a low of 6,703.96. The sector’s performance was likely influenced by short-term profit booking and cautious sentiment among investors amid mixed expectations regarding tourism flows and hotel occupancy trends in the current season.

Although the sector saw a slight dip, it remains a key component of the NEPSE due to its growing potential in the national economy and its significance in driving foreign direct investment through Nepal’s expanding tourism sector.

Market Outlook

Today’s gain in the NEPSE index highlights a short-term recovery, with momentum driven by select sectors, increased turnover, and overall positive investor sentiment. However, sectoral divergence, as seen with the Hotels and Tourism Index, suggests that market participants are navigating the equity space with a sector-specific approach rather than broad-based buying.

Investors are advised to monitor corporate earnings, economic indicators, and macroeconomic updates, including liquidity status and monetary policy direction from Nepal Rastra Bank, as these will be key in determining the market’s medium-term trajectory.

Despite some volatility, market fundamentals remain resilient, and today’s activity underscores the growing maturity and participation of retail and institutional investors in Nepal’s evolving capital market landscape.