The Nepal Stock Exchange (NEPSE) witnessed a downturn today, dropping by 13.62 points (0.47%) to close at 2,876.66. This followed a positive session in which the index gained 75.24 points. Despite the dip, the day’s trading session saw significant activity with a total turnover of Rs. 14.28 Arba, a reflection of the continuing investor participation across various sectors. The Hotels and Tourism Index, another crucial sector on the exchange, also experienced a loss, reflecting broader market trends.

The NEPSE index opened the session at 2,829.12 and showed notable volatility throughout the trading day. It fluctuated between a high of 2,890.28 and a low of 2,826.86. Investors were cautious as market sentiment fluctuated, driven by global economic indicators and domestic factors influencing the stock market. Despite these variations, the day ended with the market showing a small loss, which is typical in markets characterized by frequent ups and downs.

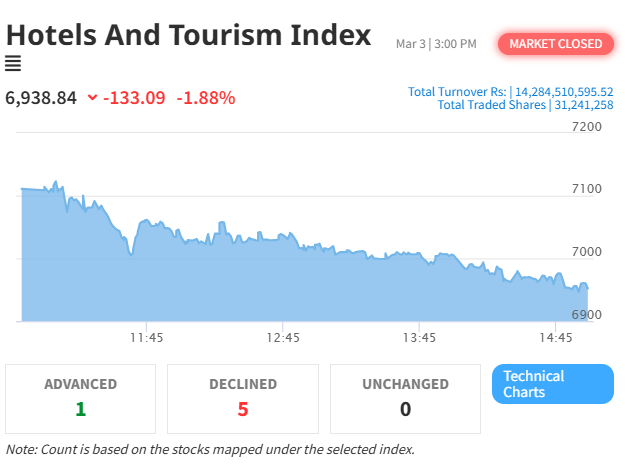

On the broader market front, a total of 31,241,258 shares were traded, covering 300 companies and involving 139,555 transactions. The turnover of Rs. 14.28 Arba highlights the liquidity in the market despite the day’s losses, showing continued investor interest and activity. However, with mixed signals from different market segments, including the underperformance in some key sectors like Hotels and Tourism, many market analysts noted the volatile nature of trading.

The Hotels and Tourism Index, a significant component of the NEPSE, saw a decline of 133.09 points (1.88%) today, closing at 6,938.84. This decline follows a significant gain of 281.67 points in the previous session. The Hotels and Tourism sector is crucial to Nepal’s economy, and its performance on the stock exchange is often an indicator of broader economic sentiment, especially in the post-pandemic recovery phase. The index opened at 7,110.76, and during the day, it fluctuated between a high of 7,122.95 and a low of 6,938.84, closing at the lower end of this range.

The trading activity within the Hotels and Tourism Index reflects the sector’s sensitivity to both domestic and international events. Nepal’s tourism industry, though recovering steadily, still faces challenges, including global economic uncertainties and domestic concerns such as infrastructure and political stability. These factors impact the performance of companies listed under the Hotels and Tourism sector, which, in turn, affects the overall market index. The previous session’s gain of 281.67 points might have been a correction or a temporary market adjustment, while today’s loss indicates the ongoing volatility in the sector.

Despite the decline in the Hotels and Tourism Index, the broader market turnover of Rs. 14.28 Arba reflects the underlying liquidity in the market, which signals continued investor confidence in the overall Nepali stock market. The market turnover is an important metric as it indicates the level of trading activity and investor participation in various sectors. Although the overall market lost ground today, the substantial turnover suggests that investors remain actively engaged in Nepal’s stock market, even if they are responding cautiously to sectoral fluctuations.

As the market continues to evolve, analysts suggest that the NEPSE index will likely experience further fluctuations, especially considering both internal and external economic factors. The stock market in Nepal is expected to remain sensitive to international market trends, especially in the wake of economic uncertainties across Asia and global financial markets. Domestically, investors are also keeping an eye on government policies, fiscal developments, and infrastructural progress, which could either positively or negatively impact market performance.

For investors in the Hotels and Tourism sector, attention will be focused on upcoming trends in the global travel industry, with hopes for a continued recovery in Nepal’s tourism sector as travel restrictions ease and global tourism regains momentum. However, challenges such as inflation, exchange rate volatility, and political developments could affect the long-term stability of this sector’s growth.

In conclusion, today’s market results illustrate the volatile nature of the Nepali stock exchange, with the NEPSE index and the Hotels and Tourism Index reflecting a combination of gains and losses in a rapidly changing market environment. While the losses seen today are relatively small, they signal the need for careful monitoring and strategic investment decisions as Nepal’s stock market navigates ongoing uncertainties. Despite the setbacks, the active participation and liquidity suggest that the market holds potential for growth in the near future.