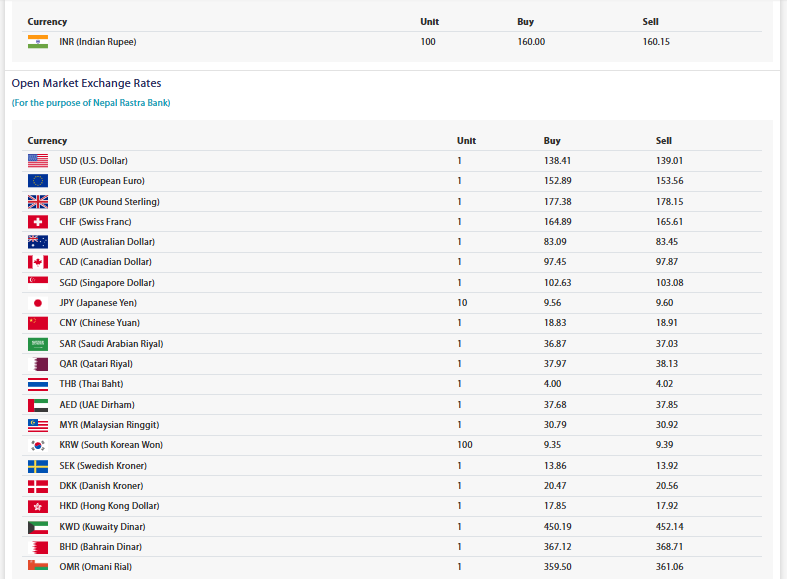

The Nepal Rastra Bank (NRB), the central monetary authority of the country, has published the official foreign exchange rates for April 10, determining the buying and selling rates of various international currencies against the Nepalese Rupee (NPR). These rates, applicable for today, guide commercial banks and financial institutions in conducting foreign currency transactions and are critical for importers, exporters, travelers, and remittance receivers.

According to the latest update by NRB, the exchange rate of the US Dollar, one of the most commonly traded foreign currencies in Nepal, has been fixed at Rs. 138.41 for buying and Rs. 139.01 for selling. This rate reflects the slight fluctuation in the dollar’s strength in the global currency market and continues to play a crucial role in Nepal’s foreign trade and remittance flows.

In the case of the European Euro, the central bank has set the buying rate at Rs. 152.89 and the selling rate at Rs. 153.56, marking a steady exchange level in the region’s trading activities. Likewise, the UK Pound Sterling, which has historically remained strong in global markets, is being traded at Rs. 177.38 for buying and Rs. 178.15 for selling.

Among other major global currencies, the Swiss Franc has been fixed at Rs. 164.89 (buying) and Rs. 165.61 (selling), while the Australian Dollar is set at Rs. 83.09 for buying and Rs. 83.45 for selling. Similarly, the Canadian Dollar stands at Rs. 97.45 for buying and Rs. 97.87 for selling, reflecting the moderate strength of the Canadian economy in comparison to the Nepali currency.

The Singapore Dollar, which is becoming increasingly relevant due to rising business and travel ties between the two nations, is being exchanged at Rs. 102.63 for buying and Rs. 103.08 for selling. Meanwhile, the Japanese Yen, calculated per 10 units, is valued at Rs. 9.56 (buying) and Rs. 9.60 (selling).

In the Asian currency segment, the Chinese Yuan has been valued at Rs. 18.83 for buying and Rs. 18.91 for selling, while the Saudi Arabian Riyal is being traded at Rs. 36.87 (buying) and Rs. 37.03 (selling). These currencies are particularly significant due to the large number of Nepali migrant workers residing in these countries who regularly send remittances back home.

Additionally, the Qatari Riyal has been fixed at Rs. 37.97 for buying and Rs. 38.13 for selling, another important rate for Nepali workers in the Gulf region. The UAE Dirham follows closely, with exchange rates of Rs. 37.68 (buying) and Rs. 37.85 (selling).

Among Southeast Asian currencies, the Thai Baht is being exchanged at Rs. 4.00 for buying and Rs. 4.02 for selling, and the Malaysian Ringgit is set at Rs. 30.79 for buying and Rs. 30.92 for selling. Similarly, the South Korean Won, calculated per 100 units, stands at Rs. 9.35 (buying) and Rs. 9.39 (selling). From the European region, the Swedish Krona has been fixed at Rs. 13.86 for buying and Rs. 13.92 for selling, while the Danish Krone is being exchanged at Rs. 20.47 (buying) and Rs. 20.56 (selling).

In other currencies of importance, the Hong Kong Dollar is valued at Rs. 17.85 for buying and Rs. 17.92 for selling. Meanwhile, the Kuwaiti Dinar, one of the highest-valued currencies in the world, has been fixed at Rs. 450.19 for buying and Rs. 452.14 for selling.

Other Gulf currencies include the Bahraini Dinar, which is set at Rs. 367.12 (buying) and Rs. 368.71 (selling), and the Omani Riyal, fixed at Rs. 359.50 for buying and Rs. 361.06 for selling. These high-value currencies are particularly significant due to their impact on foreign remittance volumes flowing into Nepal.

The exchange rate for the Indian Rupee, calculated per 100 units, has been set at Rs. 160 for buying and Rs. 160.15 for selling. As Nepal shares an open border and strong economic ties with India, this rate affects a wide spectrum of daily economic activities, from small-scale trading to cross-border commerce.

According to the Nepal Rastra Bank, these exchange rates are subject to change at any time depending on market conditions, international currency movements, and policy adjustments. While these are the official rates provided by the central bank, it has also clarified that commercial banks in Nepal may quote slightly different exchange rates based on their own calculations and market conditions.

The NRB further stated that the most accurate and real-time exchange rates can be accessed through its official website, which is updated regularly to reflect fluctuations in the global currency market.

These daily updates by the Nepal Rastra Bank are not only essential for institutional investors and traders but also serve as an important reference for individuals planning international travel, education, or remittance-related transactions. As global economies continue to shift, these rates provide a snapshot of Nepal’s financial positioning in the international monetary framework.