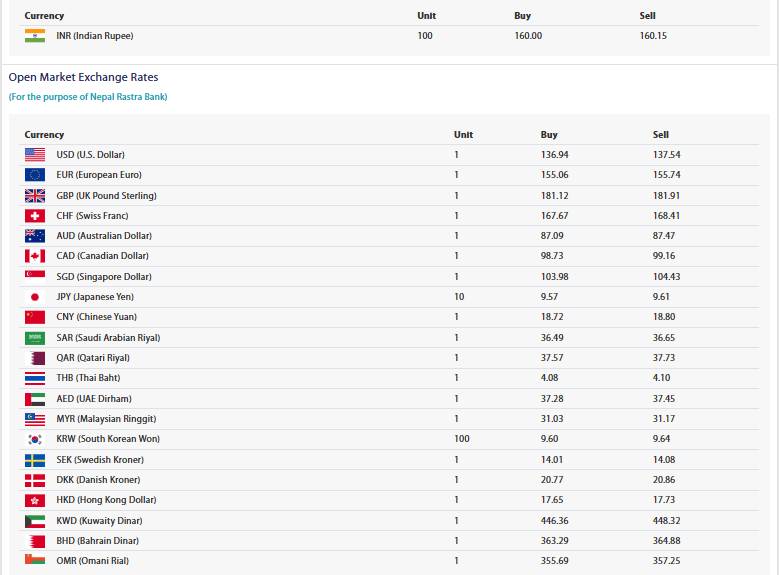

Nepal Rastra Bank (NRB), the central regulatory authority for banking and monetary affairs in the country, has published the official foreign exchange rates for April 16, 2025. As per the latest update, the central bank has determined the buying and selling rates for a variety of international currencies, which are used by commercial banks, traders, and individuals involved in cross-border transactions.

According to the NRB, the buying rate for 1 US dollar has been fixed at NPR 136.94, while the selling rate is NPR 137.54. This slight fluctuation from previous days reflects the dynamic nature of international currency markets and the country’s own foreign exchange reserves and demands.

In terms of European currencies, the exchange rate for one Euro has been fixed at NPR 155.06 for buying and NPR 155.74 for selling. Similarly, the UK Pound Sterling is being traded at NPR 181.12 (buying) and NPR 181.91 (selling). These rates reflect the strong position of European currencies in global markets and their high demand among Nepali traders and importers.

The Swiss Franc, another major currency in the international banking system, has been valued at NPR 167.67 for buying and NPR 168.41 for selling. Meanwhile, the Australian Dollar has been priced at NPR 87.09 for buying and NPR 87.47 for selling, indicating moderate activity in transactions between Nepal and Australia.

As for the Canadian Dollar, the NRB has set its buying rate at NPR 98.73 and the selling rate at NPR 99.16. The Singapore Dollar is also listed at NPR 103.98 for buying and NPR 104.43 for selling. Both these currencies are widely used for trade and remittance transactions involving the Nepali diaspora in Canada and Singapore.

Among the Asian currencies, the Japanese Yen has been set at NPR 9.57 for buying and NPR 9.61 for selling for every 10 Yen. The Chinese Yuan, another significant currency for Nepal due to the shared border and trade routes, is being exchanged at NPR 18.72 (buying) and NPR 18.80 (selling).

From the Gulf region, the exchange rate for the Saudi Arabian Riyal stands at NPR 36.49 for buying and NPR 36.65 for selling. Similarly, the Qatari Riyal is trading at NPR 37.57 (buying) and NPR 37.73 (selling). These currencies are particularly important for Nepal, given the large number of Nepali migrant workers in these countries.

The Thai Baht, often used by Nepali tourists and traders traveling to Southeast Asia, has been valued at NPR 4.08 for buying and NPR 4.10 for selling. Meanwhile, the UAE Dirham, another popular currency due to the high number of migrant workers and traders in the UAE, is being traded at NPR 37.28 for buying and NPR 37.45 for selling.

The Malaysian Ringgit, which also has significance for remittance and business-related activities, has a buying rate of NPR 31.03 and a selling rate of NPR 31.17. The South Korean Won, quoted for every 100 units, has been priced at NPR 9.60 for buying and NPR 9.64 for selling.

In the Scandinavian region, the Swedish Krona is trading at NPR 14.01 for buying and NPR 14.08 for selling, while the Danish Krone has been fixed at NPR 20.77 for buying and NPR 20.86 for selling. These currencies are occasionally used for trade and study-abroad financial transactions involving Scandinavian countries.

Other significant currencies listed in today’s exchange rate include the Hong Kong Dollar at NPR 17.65 (buying) and NPR 17.73 (selling). The Kuwaiti Dinar, known for its high valuation in the global currency market, is being traded at NPR 446.36 for buying and NPR 448.32 for selling. Similarly, the Bahraini Dinar is set at NPR 363.29 (buying) and NPR 364.88 (selling), and the Omani Riyal is priced at NPR 355.69 for buying and NPR 357.25 for selling.

In the context of the South Asian region, the Indian Rupee continues to remain stable with 100 Indian Rupees being exchanged at NPR 160.00 for buying and NPR 160.15 for selling. This exchange rate is particularly significant given Nepal’s close economic and trade ties with India, which includes a high volume of imports, exports, and remittance transactions.

Nepal Rastra Bank has stated that these exchange rates are subject to change as per market demand and conditions. The rates are applicable primarily for transactions carried out through authorized banking channels. It is also noted that individual commercial banks may offer slightly different rates based on their internal policies, foreign currency availability, and market trends.

Furthermore, NRB has emphasized that the most up-to-date exchange rates can be accessed through its official website, and users are advised to check rates regularly before engaging in any major transactions. The central bank also reserves the right to revise the published rates at any time depending on market conditions and monetary policy objectives.

This daily announcement of foreign exchange rates serves as a critical reference point for businesses involved in import-export activities, foreign currency traders, and individuals sending or receiving remittances. It helps maintain transparency, monitor currency inflow and outflow, and guide financial institutions in standardizing their currency exchange operations across the country.